Invest4Success

If, like me, you are not flush with cash to trade, I keep a Roth IRA which I use to snail-trade to wealth. This account uses a small amount of cash allocated monthly from salary - along with blog income from Google Adsense - to invest gradually in dividend income stocks. The reality is most people I have met through the years don't have the level of capital to trade successfully and would be better off using tax-efficient accounts, such as a Roth IRA, to accumulate wealth.

Invest4Success is a Stocktwits Premium room that tracks the monthly investments I make into my Roth IRA. It's a back-to-basics approach that uses well-established names, a buy-and-hold strategy, and dividend re-investment to build value. Eventually, I will use covered calls to generate additional income, but this is probably a year away.

If you are interested, it costs $249 a year, but you can get a 50% discount ($125/year) and a 14-day free trial with coupon code fallondpicks.

What is Invest4Success?

A social media feed of trades and commentary for my Roth IRA

Who is it for?

For small account holders and those looking to start investing. The typical investment is around $200 / per month.

What is the Strategy?

Buy-and-hold of dividend income stocks. Covered calls will feature later.

Post Frequency?

Around 2-3 per month are delivered via email.

Below are some of the screenshots (note, I post to the board when I need to - it's not a daily update, but I have configured it to push posts to your email so it won't be spammy):

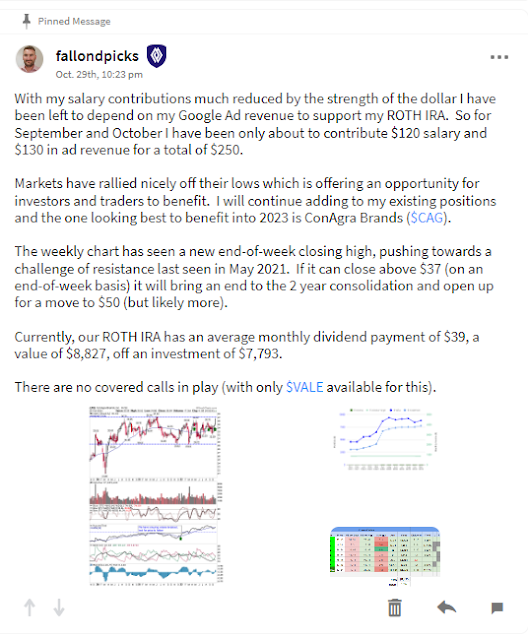

A Sample Post:

A Chart marked with Buy signals:

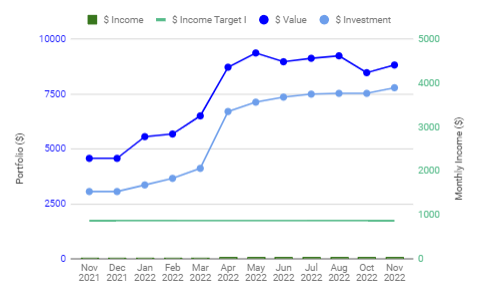

A Return Chart:

A Holdings Screenshot:

Click here to sign up